Benny Chetcuti

Benny Chetcuti, Jr. has Ellis Acted at least 48 units in San Francisco, often in collaboration with Gerald W. Filice, Chetcuti & Associates, Inc., of which he was President, and Jomorson Properties, of which he was also President. Chetcuti has been heavily reprimanded perpetuating fraud upon at least 114 victims who suffered an alleged aggregate loss of $28 million or more. In 2004, he notoriously Ellis Act evicted seniors and a tenant with AIDS from 838 Potrero through Chetcuti & Associates. He has been known to issue Ellis Act evictions after one day of buying a building.

Affiliated corporations (many inactive)

Chetcuti and Associates, Inc. - President, Active

Jomorson Properties, Inc. - President

Bates Chetcuti Monchek, Inc. - President

Falcon Capital Management LLC

Falcon Fund One LLC

O'Hara Handicapped Awarness Recreation America Foundation (O'Hara) - Director

71-73A Woodward Street Partners, L.P.

19-23 Woodward Street Partners, L.P.

55-63A Woodward Street Partners, L.P.

25-29 Woodward Street Partners, L.P.

76-80 Woodward Street Partners, L.P.

Chetcuti and Associates, which specializes in investment services, is located at: 1204 Alpine Rd, Walnut Creek, CA 94596

Phone: (925) 933-6575

FRAUD CHARGES

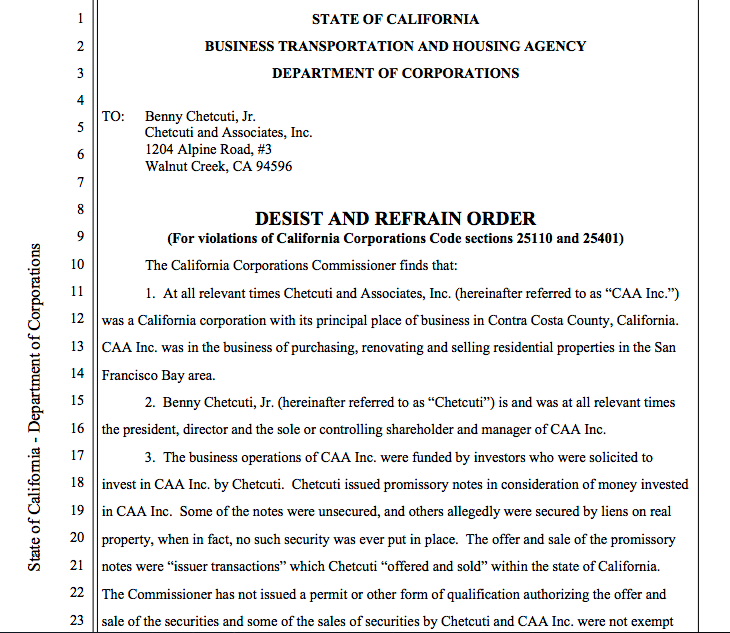

On November 16, 2011, the State of California Business Transportation and Housing Agency Department of Corporations ordered him a DESIST AND REFRAIN ORDER for violations of California Corporations Code sections 25110 and 25401. Significantly, he "made untrue statements of material fact and/or omitted to state material facts to the investors in [Chetcuti and Associates, Inc.]" He promised seven investors both money, promissory notes, and/or “possession and ownership” of housing units that were never delivered. He was also accused of forgery. The order commanded, "Pursuant to section 25532 of the Corporate Securities Law of 1968, Chetcuti and Associates, Inc. and Benny Chetcuti, Jr. are hereby ordered to desist and refrain from the further offer or sale in the State of California of securities, including but not limited to promissory notes, unless and until qualification has been made under the law. . . . Pursuant to section 25532 of the Corporate Securities Law, Chetcuti and Associates, Inc. and Benny Chetcuti, Jr. are hereby ordered to desist and refrain from offering or selling or buying or offering to buy any security in the state of California, including but not limited to the issuance of promissory notes by means of any written or oral communication which includes an untrue statement of a material fact or omits to state a material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading."

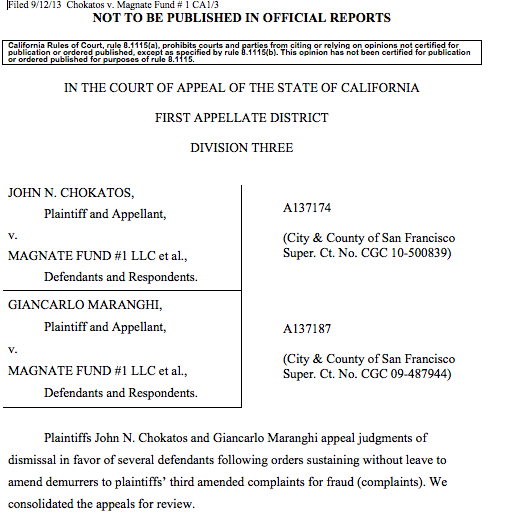

On September 12, 2013 in Chokatos v. Magnate Fund # 1 CA1/3, plaintiffs alleged that "defendant Benny Chetcuti, Jr., represented himself as an experienced real estate developer offering safe investment opportunities in his projects when, in fact, he was operating a Ponzi scheme with John Simonse and their related companies. According to plaintiffs’ complaints, Chetcuti and his company Chetcuti & Associates, Inc. (collectively, Chetcuti) 'borrowed money from his victims, usually short term loans, with the promise of high . . . returns.' Chetcuti signed promissory notes and issued deeds of trust to properties owned by himself or other entities' to secure the loans. Before recording the lenders’ deeds of trust, Chetcuti issued and recorded deeds of trust in favor of Simonse and related entities on unfunded sham loans “that would totally encumber the property.' 'Simonse and his other entities would then foreclose on the properties, leaving the victims without any security for their loans, and defendant Simonse and his entities would have free and clear title to the properties, without actually making any loans. Defendant Simonse would then create new entities, and transfer title of the foreclosed properties to the newly created entities, without any consideration, to make the properties even more removed and difficult for the creditors and victims of defendant Chetcuti to recover the security for their loans.' 'When defendant Chetcuti could not find enough investors to pay for various other loans, the scheme collapsed, leaving his victims with unpaid promissory notes with no security for their loans.' Chetcuti filed for bankruptcy. According to plaintiff Chokatos, Chetcuti perpetrated fraud upon at least 114 victims who suffered an aggregate loss of $28 million or more."

A list of contract breach and other cases can be found here.

Chetcuti is responsible for Ellis Act evicting the following buildings:

945 Capp Street (4 units) - Petition L040056, January 9, 2004. Chetcuti & Associates, Inc. with Gerald W. Filice.

1088 - 1090 Capp Street (3 units) - Petition L031140, September 4, 2003. Chetcuti & Associates, Inc. with Gerald W. Filice.

838 - 842 Potrero Avenue (5 units) - Petition L041115, September 9, 2004. Chetcuti & Associates, Inc. with Gerald W. Filice.

226 27th Street (11 units) - Petition L070844, March 20,2007. Chetcuti & Associates, Inc. with Gerald W. Filice.

2671 - 2677 Bryant Street (4 units) - Petition L060534, March 29, 2006. Chetcuti & Associates, Inc. with Gerald W. Filice.

1419 - 1425 South Van Ness Avenue (4 units) - Petition L050662, April 16, 2005. Chetcuti & Associates, Inc. with Gerald W. Filice.

55 - 63 Woodward Street (5 units) - Petition L050660, April 15, 2005. 55-63A Woodward Street Partners, L. P., Jomorson Properties.

71 - 73 Woodward Street (2 units) - Petition L041318, October 19, 2004.71-73A Woodward Street Partners, L.P., Jomorson Properties.

76 - 80 Woodward Street (3 units) - Petition L041317. 76-80 Woodward Street Partners, L.P., Jomorson Properties.

25 - 29 Woodward Street (3 units) - Petition L040912, July 16, 2004. 25-29 Woodward Street Partners, L.P., Jomorson Properties.

54 - 56 Woodward Street (2 units) - Petition L040927, July 16, 2004. 54-56B Woodward Street Partners, L.P., Jomorson Properties.

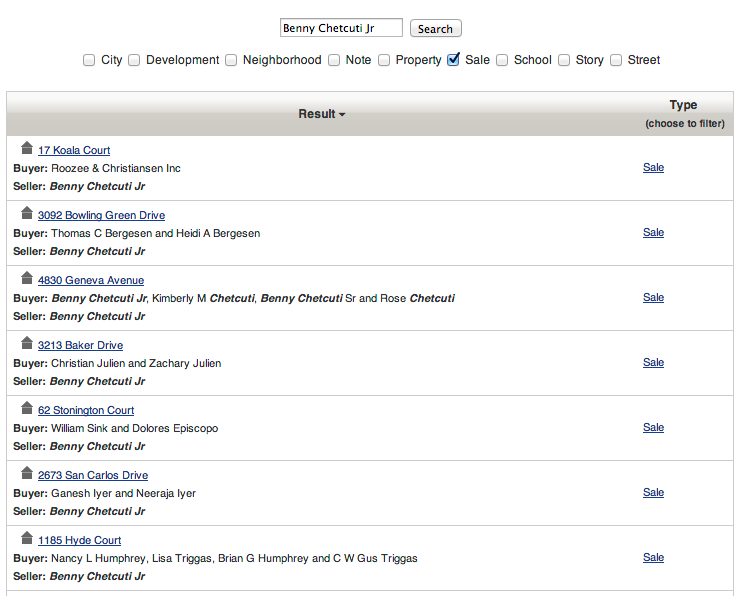

Currently, he is listed as selling 27 properties in San Francisco on Blockshoper, some in collaboration with Kimberly M. Chetcuti (family trust), Benny Chetcuti Sr. and Rose G. Chetcuti (Trustee), Family Bypass Trust Chetcuti, Samuel M Chetcuti, and Chetcuti & Assoc.